This is a redacted version of a job leveling document that I created for a small start-up that was growing exponentially. ABC Company is fictitious, but the details and deliverables are authentic. This technical document outlines possible career tracks for members of the accounting team.

Problem: As the ABC Company grew, their accounting team members wore multiple hats, pitching in where needed. This created an issue with internal controls due to the lack of separation of duties and people were confused about what they needed to do to succeed in their careers and what skills they needed to have to be promoted to the next level.

Solution: By meeting with team members and leadership, I designed a job leveling document that:

- Defined responsibilities

- Established a clear pathway for specific roles

- Created clear hierarchical levels within the organization

Job Leveling Document

Introduction

Starting in 2020, ABC Company began formalizing the career paths for the accounting team. This document outlines expectations and examples of accounting team members’ skills and responsibilities at each level. It is intended for individual reference and for discussion between accounting team members and their direct supervisors.

New hires are not eligible for promotion until after one year of employment. By year 3, if an employee has not been promoted, the manager and the employee will be required to have a conversation to ensure clarity in the reason the employee has not been promoted. There is no requirement or expectation that a team member must take on increasingly senior roles.

This development plan is a matrix of possibilities for career growth, it is not merely a one-way trajectory. Careers may include lateral movement, and there is no expectation that a team member needs to seek a particular level. There is room for growth, development, recognition, and a rich accounting career at different levels.

There is a sliding scale around the following traits that are essential for all positions on the ABC Company Accounting Team. These will not all be called out explicitly in the roles and responsibilities for each position, however they will be a consideration during the hiring and promotion processes:

- Technical ability: exhibits skillsets appropriate for the complexity of the role.

- Communication: initiates effective emails and Slack notifications; other metrics include verbal skills, proactive status updates, structured fact-based arguments, collaboration.

- Critical thinking: balances short-term needs with long-term goals; thinks about what could go wrong.

- Initiative: takes ownership, follows through to the very end.

- Interpersonal: the types of behaviors modeled when interacting with others, levels of empathy, how social situations are handled.

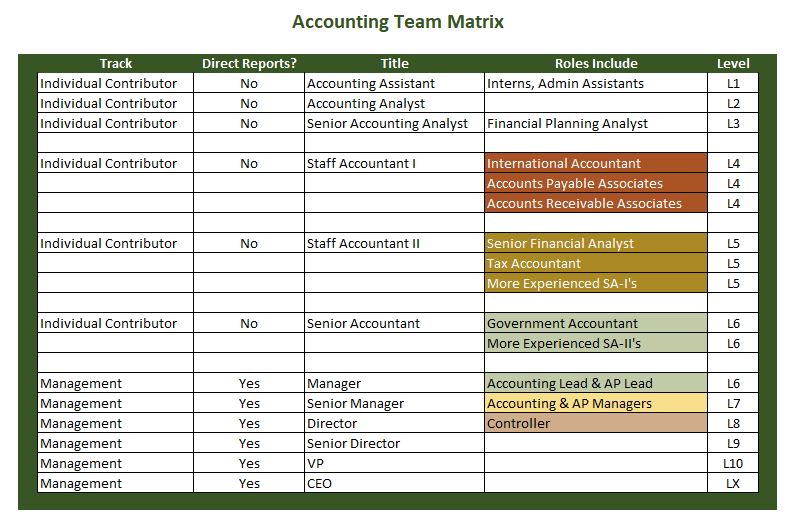

Accounting Team Matrix

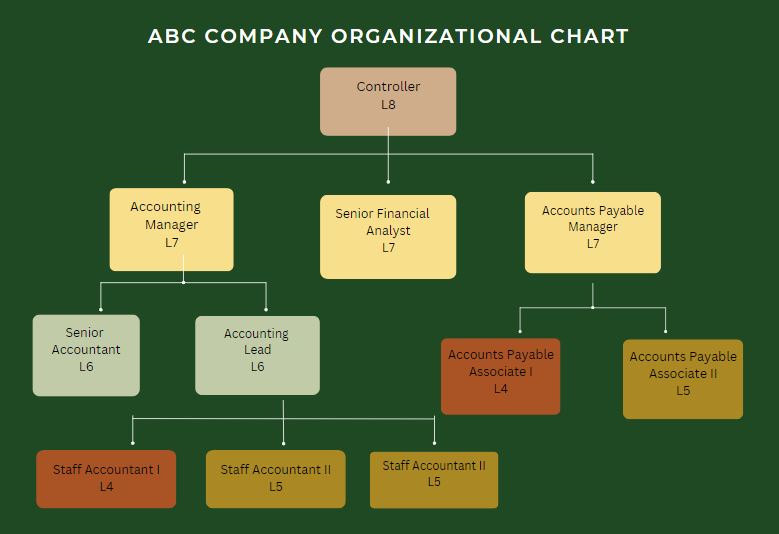

Below is the accounting team matrix that diagrams the various roles, titles, and levels that an accounting team member can hold. Each level serves a different purpose in the structure and aligns with how an employee will fit within the organization.

An employee may have a mix of skill levels across the different disciplines and roles. ABC Company aims to ensure that each employee is recognized at the most accurate level for their unique skillset and contributions.

Levels are cumulative within the respective tracks.

Each subsequent level encompasses the skills of the levels preceding it.

Accounting Team Leveling & Career Tracks

ABC Company is a start-up. Team members will assume a variety of roles and frequently will be generalists.

The linear progression of accounting assistant to senior accountant is found in established corporate environments within the general ledger team, which is a subset of the accounting team.

As ABC Company matures and teams begin developing more structured hierarchies and responsibilities, we will see more specialty-type roles emerge and sub-groups within the accounting team. Some possible sub-groups that may develop: the general ledger team, the accounts payable team, the procurement team, the accounts receivable team, the tax team.

The proficiency level for each skill may range from fundamental awareness to expert. This will be an important factor when determining appropriate accounting team levels for new hires and promoting current employees.

As of 2020, the accounting team has two tracks: individual contributor and management. The levels (L1+) map to an accountant’s seniority and scope of responsibilities. Within this scope, the roles describe the organizational need that is being filled. Levels will change as employees are promoted and roles may fluctuate based on the changing needs of the organization.

An employee can start in one track and move over to the other track. Determination of an individual contributor vs. a manager is a personal preference as employees explore roles, opportunities, and their passion.

ABC is proud of the diverse talent, personalities, and unique skills that our teams bring to our organization. Members on the accounting team are not required to have college degrees. What is important is that they have a passion for our mission, our team, and meet the high level of proficiency and competency that we require.

Whether you are an entry level member or have many years of experience, all employees are leaders, and all leaders lead with integrity and are role models.

If ABC Company meets its revenue targets, the organization could grow to 20 to 25 employees by 2025. Additional functional areas will be created to meet the accounting and compliance requirements; we anticipate requiring additional junior level headcount in various areas as demands increase: the accounts payable team is aligned with headcount, the accounts receivable team is aligned with revenue, and additions to the treasury and tax teams may transpire when we reach ~$100mm in revenue.

INDIVIDUAL CONTRIBUTOR TRACK - Titles & Descriptions

Individual contributors focus on more tactical aspects and how things are done within the team. They are recognized for their productivity and technical ability as they progress. They need management skills when they reach L5+.

Skills associated with each discipline include but are not limited to the responsibilities included below.

Accounting Assistant (Level 1, Individual Track)

Experience: zero or limited accounting background.

Roles include: Administrative Assistant, Interns.

The variety of responsibilities, the level of engagement and the degree of responsibility may be interesting & fulfilling. Individuals at L1 are supportive of the accounting team, they will handle a mix of financial and administrative responsibilities. They will learn the interdependencies of other members, be able to identify the various SMEs of the accounting team disciplines, the deadlines and time constraints we work within. They will work with a team lead or manager to ensure that tasks and objectives are clearly understood and will proactively request help or clarity when necessary. They will learn various tools and resources that the team accesses regularly and will build their understanding through experience.

Someone in this role is curious about accounting, they want to become familiarized with the various roles and see if accounting is an area that they wish to pursue. They might be an intern, student, someone interested in exploring a career in accounting. This could be a part-time or full-time role.

Note: ALL employees on the accounting team handle confidential information.

Responsibilities may include:

- Handling & distributing mail.

- Bank deposits.

- Customer & vendor inquiries.

- Triage the @ABC.com inboxes (directing internal and external inquiries).

- Pulling documentation for financial audits.

Accounting Analyst (Level 2, Individual Track)

Experience: employees at L2+ are expected to be comfortable with Excel and have had exposure or familiarity with an ERP.

At the L2 level, employees exhibit their abilities to work on some projects and tasks independently, asking for guidance in unfamiliar areas. They provide meaningful contributions and commit and complete tasks within expected time frames. They can be trusted to be held accountable. They work collaboratively and proactively engage and communicate in meetings, including status updates to teammates and managers.

Responsibilities may include:

- Compile professional reports.

- Prepares 1099s.

- Research short pays and other transactions.

- Calculates use tax.

- Keys expense reports and handles inquiries.

- Processes payroll and timesheets.

- Makes purchases, pays bills, applies payments against invoices.

Senior Accounting Analyst (Level 3, Individual Track)

Experience: 2+ years of experience.

Roles include: Senior Financial Planning Analyst.

At the L3 level, an employee may supervise one or more employees. They have more advanced knowledge of various financial disciplines and can objectively evaluate whether they have met their goals. They are accountable end-to-end, thoroughly planning and organizing their schedule and assisting those that they supervise with organizing their schedules.

Responsibilities may include:

- Recommends banking/treasury strategies.

- Audits employee benefit allocations.

- General ledger reconciliations.

- Prints financials, ensures data is entered correctly.

- Advises and evaluates.

- Updates equity tables.

- Familiar with GAAP and government policies & compliance.

- Prepares monthly sales tax returns and zero dollar returns.

Staff Accountant 1 (Level 4, Individual Track)

Experience: 2+ years of experience; thorough knowledge of basic accounting procedures and principles.

Roles include: International Accountant, Financial Planning Analyst, Accounts Payable Associate, Accounts Receivable Associate.

At this level, employees understand the roles of L1 to L3 and have a beginner-to intermediate level of understanding of the L4 role; they are familiar with standard concepts, practices, and procedures. They engage and collaborate with team members as well as peers; proactively learning the business, seek feedback to improve and they accept job-related assessments professionally. They draft professional messages, are organized, and can handle multiple projects.

Responsibilities may include:

- Reconciles balance sheet accounts, maintains schedules.

- Documents processes, workflows.

- Tracks accounts receivable.

- Collaborates with accounts payable and accounts receivable to manage invoices and payments.

- Prepares schedules for audit.

- Monitors and follows up on past-due invoices.

- Maintains fixed asset schedules.

- Updates budget schedules.

- Invoices customers.

Staff Accountant 2 (Level 5, Individual Track)

Experience: 3+ years of experience.

Roles include: International Accountant, Tax Accountant, Senior Financial Planning Analyst.

At this level, employees are familiar with ABC Company’s products & services and the inter-dependencies among teams. They have an awareness of business trends and the various industries that ABC Company transacts with. They have an intermediate understanding of accounting and reporting standards.

It is not a requirement to be a manager at this level. Some individuals will prefer having an independent role and having higher level responsibilities delegated to them, without managing direct reports on a regular basis.

This role delegates tasks and follows-up on those tasks. The individual understands that even though a project/task has been shifted to someone else, they are still ultimately on the hook for results. Follow-up may not be to a subordinate; it may be to someone else within the organization, to individuals that are on same level, junior, or senior, or it could be outside the organization altogether.

They will ask for guidance in unfamiliar areas, pulling in others as needed. They persist despite adversity.

They are comfortable analyzing trends, costs, revenues, financial commitments, and obligations, they consistently meet deadlines and set realistic deadlines that drive effort but support healthy work habits. They operate with a higher level of independence.

This requires a results-oriented individual. They can deliver their work despite distractions and can work with minimal guidance. You can trust that when a project/task is delegated to this individual, they will act and see it through. They will follow up, communicate as needed to whoever needs to be informed, including within and outside the accounting team. This individual represents the accounting team well to others within the company. They may participate in the hiring process.

Responsibilities may include:

- Records, reviews, & recommends journal entries.

- Responsible for reconciling balance sheet accounts, questioning variances.

- Reviews expense reports.

Senior Accountant (Level 6, Individual Track)

Experience: 3-5 years of accounting, accounting, or government contracting experience.

Employees at this level demonstrate their line of reasoning, can show their logical thought processes and problem-solving, even if they do not know the exact answer. They consistently follow best practices, becoming a Subject Matter Expert (SME) for at least one accounting team discipline. They ensure their discipline of expertise is properly documented and consider modifications and adoption of internal control procedures. They initiate meetings as needed, raising questions, and resolving issues. Since not all team members are able to attend all meetings, nor is that an efficient use of time, they communicate what other team members need to know on a timely basis. They can voice concerns in a constructive and professional manner.

An employee at this level is comfortable providing helpful feedback to peers and direct reports and is capable of mentoring less experienced members of the team. They identify and suggest solutions to problems impacting the team. They communicate issues and decisions clearly and proactively, sharing bad news quickly. They have mastered the ability to express complicated issues in a simplified manner.

They seek to understand other points of view, displaying empathy. They are entrusted to do what they say they will do and communicate promptly whenever there is an issue.

Note: an L6+ may supervise 1 or more employees.

Responsibilities may include:

- Reviews all costs associated with contract billing processes and requirements.

- Validates that costs are properly allocated to government contracts and unallowable costs are excluded.

- Creates invoices in accordance with FAR Standards.

- Maintains DCAA-compliant billing files.

- Distributes invoices in an approved government format for 1034 and 1035 forms.

- Monitors and manages unbilled receivable balances and prepares unbilled analysis and reconciliation on all current and completed contracts.

- Creates accounting procedures which company with state laws.

- Evaluates internal control procedures.

- Lead meetings.

- Reviews expense reports.

- Prepares financial reports.

- Research & create financial statement footnotes.

- Reviews others’ work.

MANAGEMENT TRACK - Titles & Descriptions

Manager (Level 5, Management Track)

Experience: 5+ years of accounting/financial experience and 1+ years of supervisory experience.

Roles include: General Ledger Accounting Manager, Accounts Payable Manager

Employees at the L5+ level will be teaching other team members, enabling all to grow strong together. The expectation in this role (and all levels above this) is that all financial information that they compile, report, and share is accurate and timely.

Managers are expected to participate in continuing their professional education. This can be accomplished through a variety of methods such as webinars, seminars, reading professional material, blogs, LinkedIn, books. They are expected to share pertinent knowledge that they have attained to pull/push the team/organization forward.

They inspire teamwork, are supportive to team members, helping them achieve their goals. They participate in the hiring process, providing clear and timely feedback on candidates. They prioritize and delegate work by planning, implementing, and overseeing. They have extensive knowledge of accounting department processes. They may have experience or exposure in mergers, acquisitions, or possess global operational experience.

Responsibilities may include:

- Reviews all costs associated with contract billing processes and requirements.

- Validate that costs are properly allocated to government contracts and unallowable costs are excluded.

- Hire, Train, and manage team members.

- Manage and oversee daily accounting.

- Sales, variance, and trend analysis, audit, budget, forecasting & reporting skills.

- Prepare and distribute reports and data to senior management.

- Recommends cost reduction and/or policy initiative strategies.

- Cross-trains team members.

Senior Manager (Level 6, Management Track)

Experience: 8+ years of accounting/financial experience and 3+ years of supervisory experience.

To progress to L6+, the desire to manage, coach, & develop oneself & others is a prerequisite. Individuals in this role and beyond share their experience and expertise to help others grow. They lead, coach, des-escalate conflicts and build consensus for decisions, are sought out to mentor and provide professional guidance. They handle ambiguity, self-direct, anticipate challenges and explore alternatives and tradeoffs.

Responsibilities may include:

- Oversees audit engagements.

- Liaison with outside professional advisors.

- Builds cross-functional relationships within the company.

- Explores technologies to automate or make processes more efficient.

- Oversees implementations.

Director (Level 7, Management Track)

Experience: Minimum of 10+ years of experience.

Responsibilities may include:

- Motivates and empowers the team to achieve higher levels of performance and productivity.

- Educates colleagues/companywide on team developments.

- Expert knowledge.

- Identifies & solves problems; advocates their priority.

- Supports inter-team dependencies.

- Collaborates across the organization, coordinates communication, identifying the resources.

- Trusted to maintain transparency with stakeholders, remedies communication issues.

Senior Director (Level 8, Management Track)

Experience: Minimum of 10+ years of experience.

Responsibilities may include:

- High impact, critical, future-facing decisions.

- Advance technology that will be impactful to organizational success.

- Examines & evaluates the cost-efficiencies of each department.

- Works with department heads to discuss & explain their financial statements.

- Prepares internal reports for executive leadership to support decision making.

- Respected leader and contributor within the company.

- Communicates complex issues to diverse audiences inside and outside the company.

Vice President (Level 9, Management Track)

Experience: Minimum of 15+ years of experience.

Responsibilities may include:

- Expert in multiple financial disciplines.

- May work with executive team, providing high level guidance.

- Communicates strategic vision to directors and managers to ensure all are in alignment with organizational goals.

- Examine, analyze, and evaluate the organization’s financial activities and map out the company’s financial future.

- Works with department heads to prepare budgets and consolidate them into the overall corporate budget.

Chief Financial Officer (Level X, Management Track)

Experience: Minimum of 15+ years’ experience.

Responsibilities may include:

- Anticipates future needs of the organization.

- Anticipates future needs of the organization.

- Influences company goals and strategy.

- Considers opportunities for the company to expand or grow.

- Maps organizational growth plans, including capital expenditures and investments.

- Generates three- to five-year financial forecasts.

- As a member of the executive team, provides guidance.

- Recommends financing structures (debt and equity) and considers the company’s cost of capital.